L’eau est essentielle à la vie et sa disponibilité en milieu professionnel est cruciale pour le bien-être des employés. Dans de nombreuses entreprises, l’installation d’une

Lire la suiteLa sécurité électrique est un enjeu majeur dans tous les secteurs d’activité, et plus particulièrement dans ceux impliquant des travaux d’ordre électrique. L’habilitation électrique, une

Lire la suiteL’avènement du numérique offre des possibilités infinies pour l’auto-entrepreneur aspirant à la réussite en ligne. Avec l’essor d’Internet, créer son activité et l’épanouir sont à

Lire la suiteL’essor de l’intelligence artificielle (IA) a initié un débat sans précédent au sein du domaine du droit d’auteur. Un nouveau champ de bataille est né

Lire la suiteNaviguer dans le monde du travail n’est pas toujours une tâche facile. Entre les contrats de travail, les conventions collectives, les formations professionnelles et les

Lire la suiteDans le monde des affaires numériques d’aujourd’hui, le choix et l’utilisation d’un nom de domaine peut être comparé à l’achat d’un bien immobilier. Il s’avère

Lire la suiteDans un monde où chaque personne est plus que jamais interconnectée, la reconnaissance faciale se positionne comme l’un des outils les plus avant-gardistes de l’ère

Lire la suiteEn ces temps où le monde entier se mobilise pour lutter contre le changement climatique, la question de l’efficacité énergétique des bâtiments se pose avec

Lire la suiteDans le monde numérique d’aujourd’hui, les logiciels sont omniprésents. Ils sont le moteur de presque tous les aspects de notre quotidien, de nos smartphones à

Lire la suiteÀ la croisée des échanges internationaux, Calais se dote d’un arsenal de services douaniers clé en main. L’Agence de Services et d’Assistance en douane (ASA)

Lire la suiteLes cabinets de conseils en ressources humaines jouent un rôle crucial dans le paysage professionnel d’aujourd’hui. Leur expertise est devenue un pilier pour les entreprises,

Lire la suiteLe portage salarial séduit de plus en plus de professionnels indépendants, attirés par la flexibilité et la sécurité qu’offre ce statut hybride. Comprendre son cadre

Lire la suiteSélectionner le bon consultant SEO en France exige discernement et connaissance des critères fondamentaux. Expérience avérée, maîtrise des coûts, réputation fiable : ces éléments forment

Lire la suiteOpter pour une fonderie d’aluminium est une décision stratégique majeure. Choisir ce métal léger, mais robuste promet une révolution dans la création des pièces :

Lire la suiteFace à l’évolution des besoins d’assistance à domicile, Unaide se révèle être le compagnon idéal pour une prise en charge harmonieuse et sécurisée du quotidien.

Lire la suiteDe nombreuses personnes ne connaissent pas encore qu’intelligence artificielle ou IA intervient aussi dans la création d’images. Au premier abord, cela peut susciter des questions,

Lire la suiteLes hangars agricoles photovoltaïques représentent une convergence innovante entre rentabilité économique et durabilité environnementale dans le secteur agricole. Ces structures polyvalentes combinent la fonction traditionnelle

Lire la suiteEntamer une carrière d’avocat implique un parcours semé d’épreuves mais aussi de victoires formatrices. Du choix stratégique de vos études en droit à la préparation

Lire la suiteAvis aux futurs acquéreurs : acquérir un container implique plus que trouver le bon prix. Saviez-vous que la fonction prévue, qu’il s’agisse de stockage ou

Lire la suiteDéceler le talent en horlogerie requiert de la précision et un œil expert, semblable à l’art de l’horlogerie lui-même. Les employeurs en quête de professionnels

Lire la suiteChaque voyage est une promesse d’aventure, mais aussi une prise de conscience de l’importance de la sécurité personnelle. La pochette sécurisée, à peine perceptible mais

Lire la suiteAffrontez-vous des échos persistants ou des coupures intempestives lors de vos sessions en visioconférence ? La communication à distance, indispensable dans notre quotidien professionnel, peut

Lire la suiteA l’ère numérique, la visibilité en ligne est un aspect très important pour toute entreprise. Derrière un site captivant et efficace, il y a une

Lire la suiteGérer une résidence pour personnes âgées requiert précision et attention. Le logiciel de gestion devient un allié puissant, optimisant le quotidien des gestionnaires et du

Lire la suiteFace au défi constant de l’optimisation organisationnelle, les entreprises se tournent vers les cabinets de conseil en organisation pour une expertise spécialisée. De la redéfinition

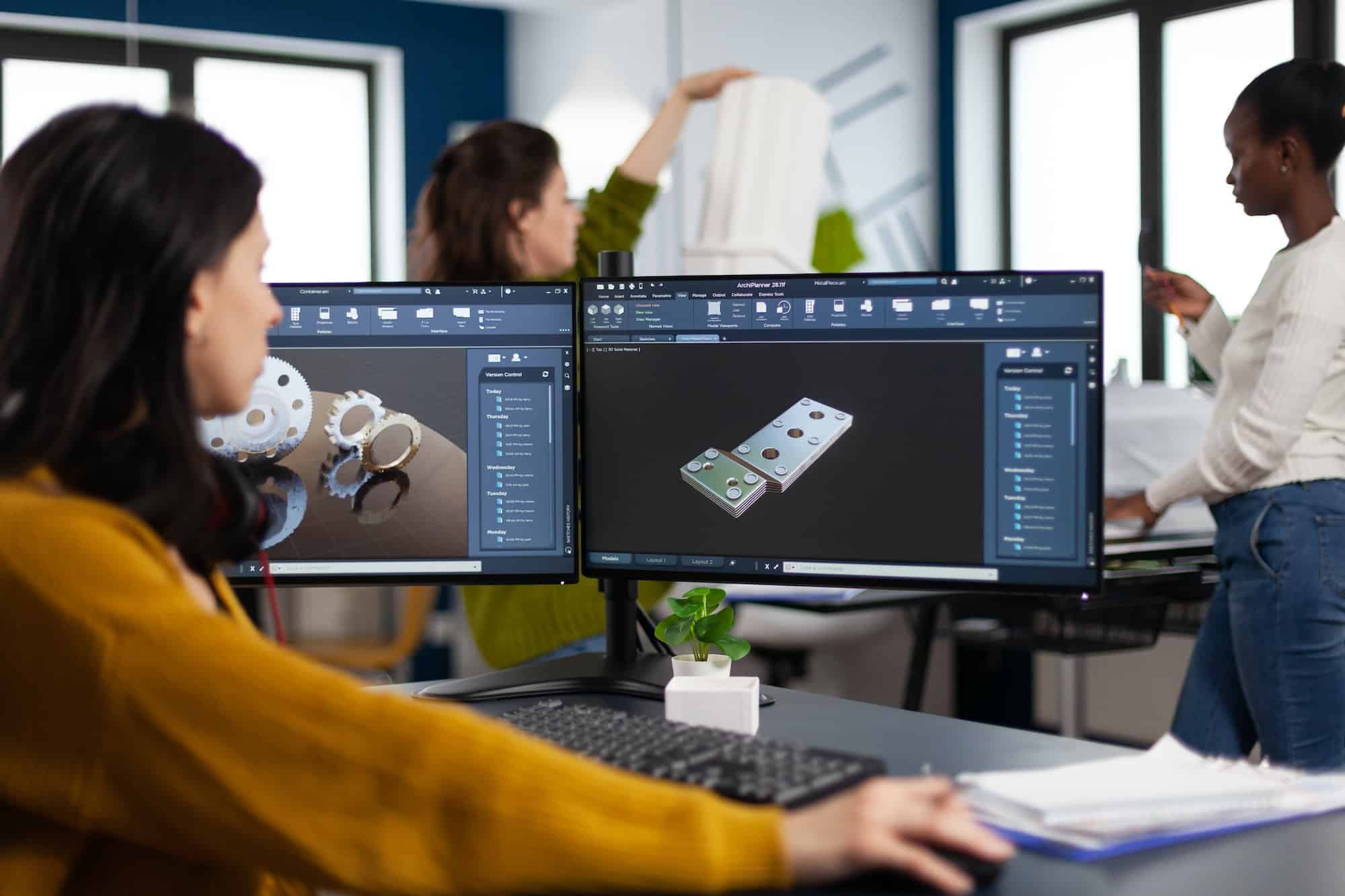

Lire la suiteL’Architecture, l’Ingénierie et la Construction ont été transformées par l’avènement de la Modélisation des Informations du Bâtiment (BIM) et l’Assistance à la Maîtrise d’Ouvrage (AMO).

Lire la suiteDans un univers professionnel où chaque détail compte, confier la création de votre présentation à une agence PowerPoint qualifiée n’est pas qu’une option : c’est

Lire la suiteVous avez demandé des devis de déménagement ? Vous avez constaté des différences dans chaque document alors que l’itinéraire est le même ? Trouvez dans cet article

Lire la suiteAvant de plonger dans le vif du sujet, rappelons l’importance d’une planification méticuleuse : l’évaluation des besoins de l’entreprise, l’établissement du budget, la sélection de

Lire la suiteIl est parfois difficile de se faire connaitre lorsqu’on entreprend une nouvelle activité professionnelle. En effet, non seulement les adversaires sont nombreux, mais il est

Lire la suiteLes cloisons mobiles de type atelier sont des éléments essentiels pour optimiser l’espace dans divers environnements. Que ce soit dans un atelier, un bureau ou

Lire la suiteLes bornes escamotables anti bélier peuvent faire office de bornes anti intrusion. En les achetant auprès d’une entreprise spécialisée dans le domaine, vous pouvez obtenir

Lire la suiteLes chambres de métiers et de l’artisanat sont des entités publiques administratives relevant de l’État, sous la supervision du Ministre en charge de l’économie et

Lire la suiteLa newsletter, familière, inonde quotidiennement votre boîte mail. Un moyen privilégié pour connecter avec vos prospects et fidéliser votre clientèle. Elle véhicule divers messages :

Lire la suiteLes préjudices corporels peuvent laisser de très nombreuses séquelles pour les victimes. Celles-ci peuvent être psychologiques, mais aussi physiques. Malheureusement, il est courant de voir

Lire la suiteQuoi de mieux qu’avoir la possibilité de préparer son avenir professionnel dans une ville qui offre tant d’opportunités en formations ! Formations dans divers domaines et

Lire la suiteChoisir la bonne entreprise de livraison d’eau est une décision importante pour s’assurer que votre approvisionnement en eau est de haute qualité et répond à

Lire la suiteLe SEO, ou Search Engine Optimization, est un élément fondamental pour la réussite d’un site internet. Une stratégie SEO efficace implique de déployer des méthodes

Lire la suiteLes enjeux environnementaux sont aujourd’hui au cœur de toutes les préoccupations. L’empreinte carbone des activités humaines pèse sur la planète, mais il existe des moyens

Lire la suiteLes différentes missions d’une entreprise ne peuvent être atteintes sans l’intervention de son personnel. Ces derniers constituent une ressource dont la gestion est confiée au

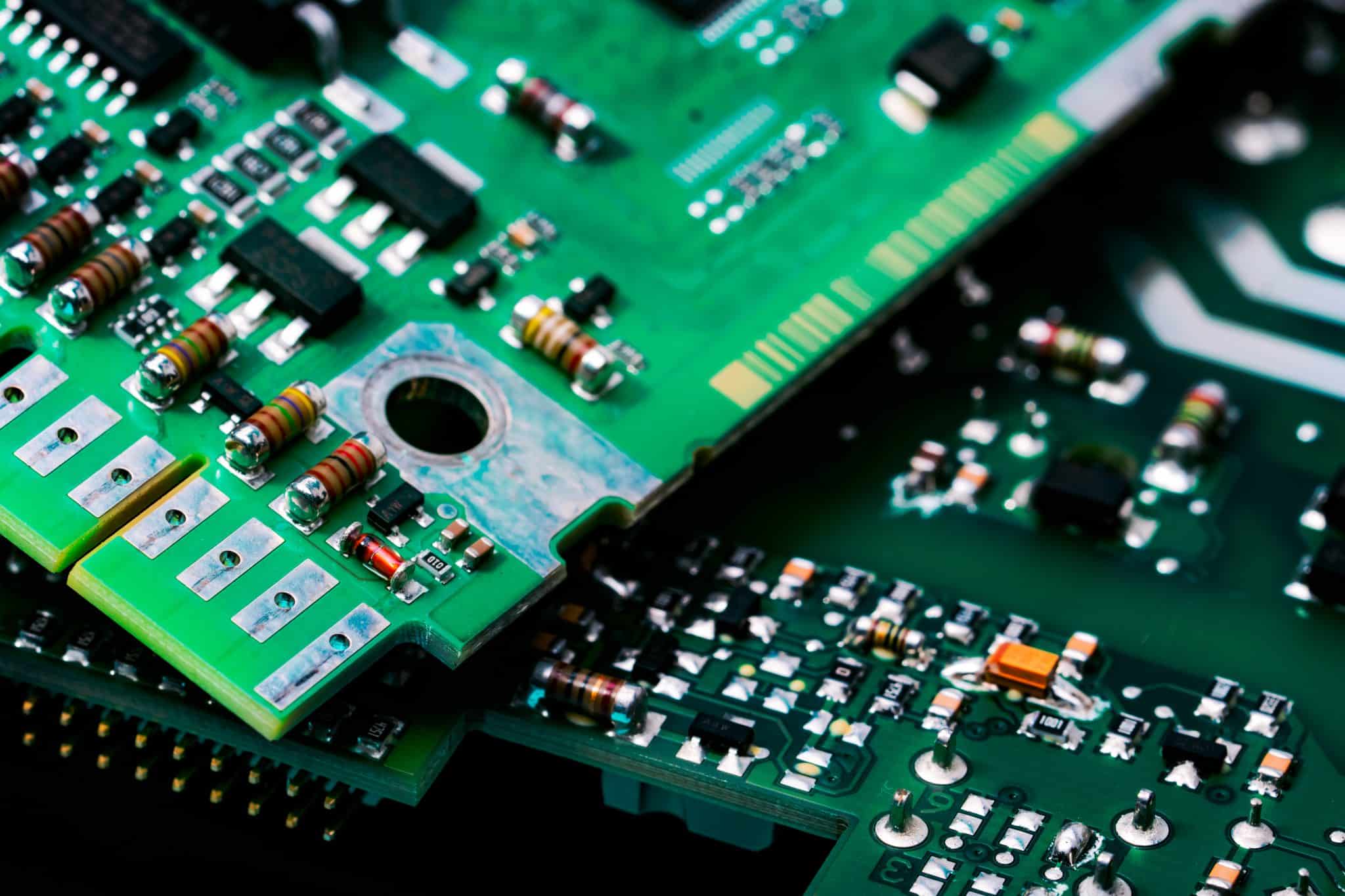

Lire la suiteLa fabrication d’une carte électronique est un processus complexe qui nécessite une grande précision et un contrôle rigoureux de la qualité. Or, les cartes électroniques

Lire la suiteDans le monde du travail, les conflits sont presque inévitables. Ils peuvent surgir de désaccords personnels, de déséquilibres de pouvoir, de mauvaise communication ou simplement

Lire la suiteDans le monde de l’entreprise, la diversité n’est plus seulement une question de conformité légale ou de responsabilité sociale. Non, elle est devenue un impératif

Lire la suiteDans le monde du travail, le stress et la pression sont des réalités incontournables. La situation est d’autant plus critique lorsqu’il s’agit de managers qui

Lire la suiteEn matière d’emploi, les compétences sont la clé de voûte d’un parcours professionnel réussi. Bien au-delà des diplômes et des expériences professionnelles, ce sont vos

Lire la suiteDans un monde où le rythme de travail s’accélère, il est primordial pour le salarié de savoir gérer son stress et de prendre soin de

Lire la suiteSaint-Malo est une ville côtière de la région Bretagne française qui est traditionnellement un centre de l’industrie maritime. Entourée par l’océan Atlantique, cette belle ville

Lire la suiteDepuis ces derniers temps, on constate que les équipes RH d’une entreprise s’efforcent constamment d’améliorer l’acquisition et le développement des compétences de leurs collaborateurs. En

Lire la suiteÉtant donné les avantages de louer un box de stockage, de plus en plus de sociétés proposent ce genre de prestation. La location de box

Lire la suiteL’outil CRM personnalisé permet à une entreprise de mieux gérer son organisation quotidienne. Non seulement, l’outil est une alternative efficace pour gagner du temps dans

Lire la suite